The meme aper's guide to trading

The parallels between shitcoin sniping and pre-seed VC investing (Part 2/3)

Table of Contents

Getting to the Starting Line

In the last article we went over what meme coin sniping is and some parallels it has with pre-seed VC investing. Now before you can start trading meme coins, there are a few steps to go through. New meme coins are not available on centralized exchanges (CEX) like Coinbase, Binance, ByBit, Kraken, etc. The only way to swap them is by going to decentralized exchanges (DEX), which is more involved than simply swiping your credit card. Below is a sequence of steps that I will take you through:

How to swap fiat for cryptocurrency on CEX

How to take direct control of your tokens

(Base only) How to bridge and wrap ETH on Base

How to swap network native tokens for meme coins on DEX

This article will be a simple guide that covers the absolute basics of how to start trading. Once again, I do not advocate participating in meme coin trading due to the inherent risks involved but I wanted to provide a guide for those who are curious anyway. Strategies and due diligence check lists will follow in part 3. The UK is quite limited in CEX choices, so my following example will be only illustrated with Coinbase screenshots.

Swapping fiat on CEX

The first step is to register on a CEX like Coinbase and buy some native tokens for the blockchain you have decided to play on. Purchase Solana if you plan on playing there, and Ethereum (ETH) if you plan to play on Base. ETH itself could be a great long term holding, although some of its potential gains have just been priced back in the last two days.

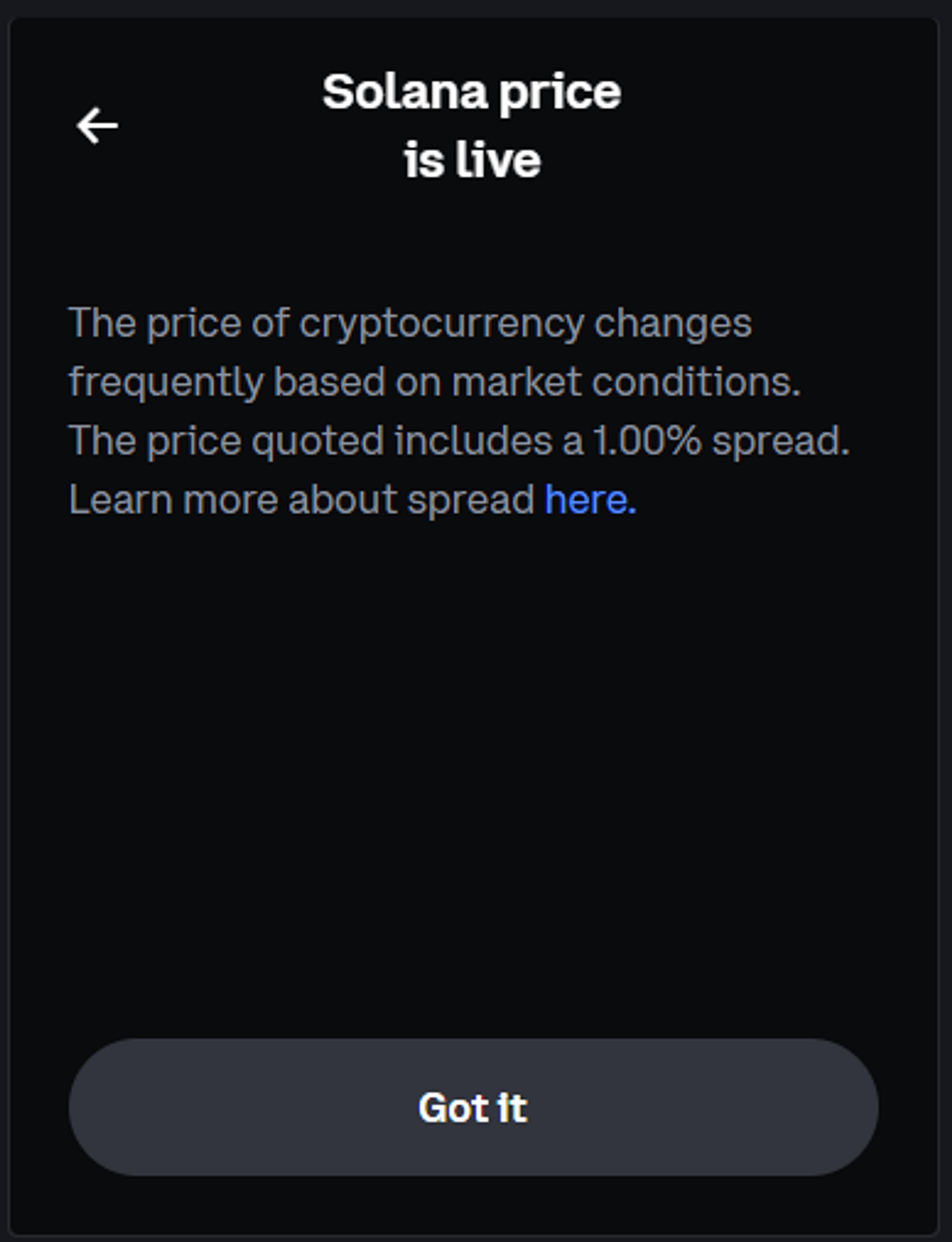

Coinbase has high transaction fees and automatically adds a 1% spread if you are using their basic interface, making purchases more expensive. For all transactions on Coinbase, you can save cost by using their advanced interface to place limit orders.

Here’s what the basic UI looks like when you try to buy tokens on Coinbase. Note the difference in the market price and the quoted price due to the spread they automatically add. There is also a Coinbase fee that could add up depending on how much and how frequently you are transacting. One way to bypass the Coinbase fee is to get the Coinbase One subscription if you will be executing more than two or so dozen trades per month:

Note how the actual price you’d pay ends up being slightly higher than the price they quoted in the previous screenshot:

This is due to the spread that Coinabse automatically adds on in their “Basic” interface:

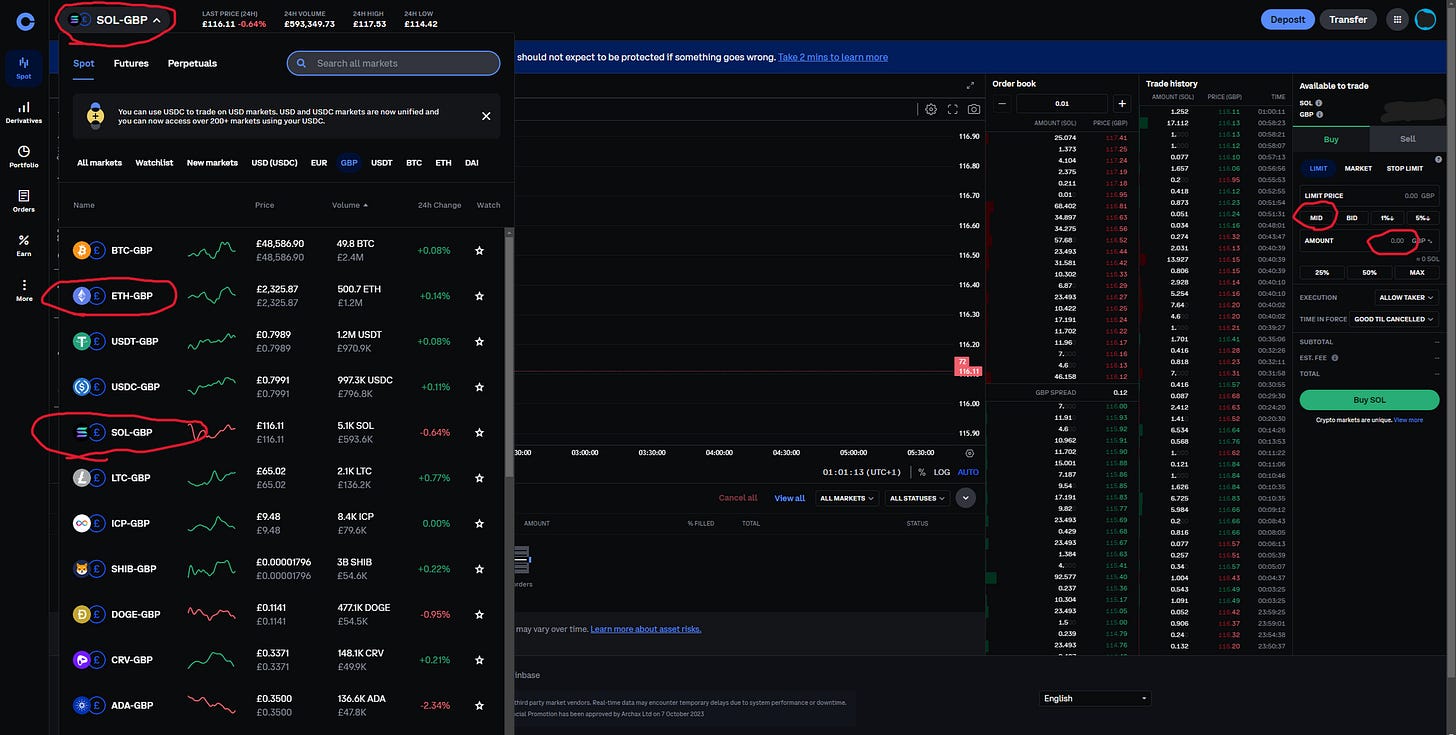

The way to avoid the automated spread and buy at the exact market price is to use the Coinbase advanced interface as shown below:

Select the crypto-fiat pair you want to trade. Then on the right side, place a limit order at a price that you desire, if you want something immediately, enter a price slightly above current market price or click “Mid”. Enter the amount you wish to buy then click the green buy button:

Once again, you run very material risks of losing all your invested assets in meme coin trading (or most of crypto for that matter), only play with money you can afford to lose.

Taking control of your tokens

Once you have your tokens, you need to take control of them on a non-custodial wallet so that you can actually swap them on a DEX. The most popular wallet currently is the Phantom wallet, other choices include Trust, Rabby, Coinbase wallet, and good old Metamask. You will likely need more than one of these wallets eventually, as not all wallets support all blockchain networks. Absolutely make sure you are downloading the wallet extension from their official site; there are scam mimics for all popular wallets out there waiting to ensnare people’s cryptos.

Note that Phantom wallet does not support the Base network. Coinbase wallet would be the best choice if you are playing on Base. The difference between Coinbase wallet and the Coinbase platform is that you can directly control and swap the cryptos you hold on your Coinbase wallet using DEX. This is not possible on the Coinbase platform. For those moving serious size, it is important to understand the difference between hot vs cold wallets, but this is not important for smaller players just starting out.

Once you have your wallet extension installed on your browser or mobile, you need your wallet address in order to receive cryptos from your CEX. You need to understand the following about your wallet:

Your private key

Your recovery phrase

Wallet address

Your wallet’s private key and recovery phrase serve the same purpose—total unrestricted access and ownership of that wallet. You must absolutely keep these safe and private. Losing both of these would mean permanent loss of access to your wallet and its contents. Your wallet address, on the other hand, is a public key that allows other wallets to send assets to it. Assets on different chains will have different wallet addresses. For example, a Phantom wallet by default has three addresses: one for the Solana chain, one for the ETH chain, and one for the Polygon chain.

To transfer Solana or ETH to your wallet, copy the appropriate wallet address as shown below (Example with Phantom wallet):

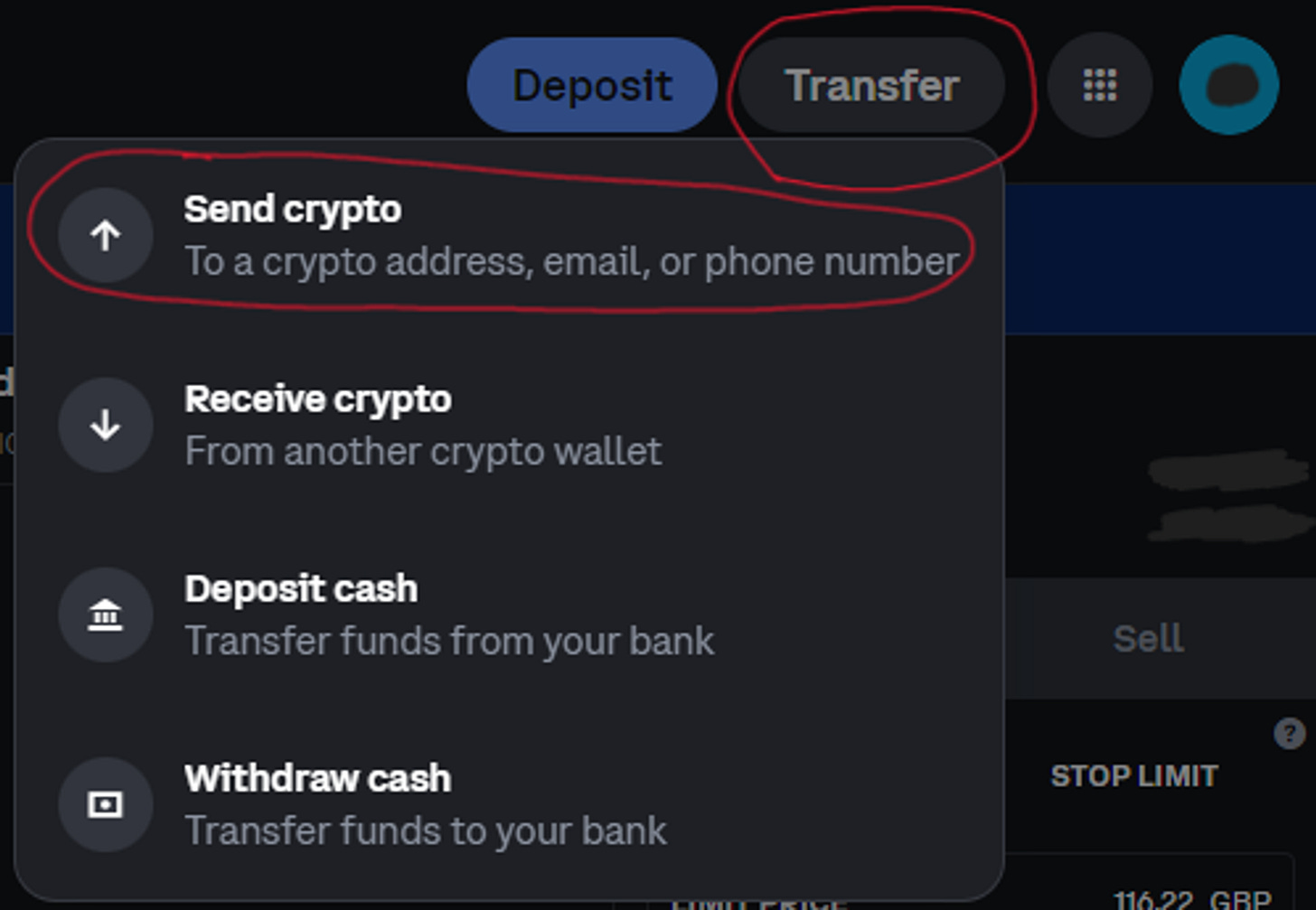

Then transfer the cryptos you bought on Coinbase to your corresponding wallet address by clicking “Transfer” on Coinbase and “Send Crypto”:

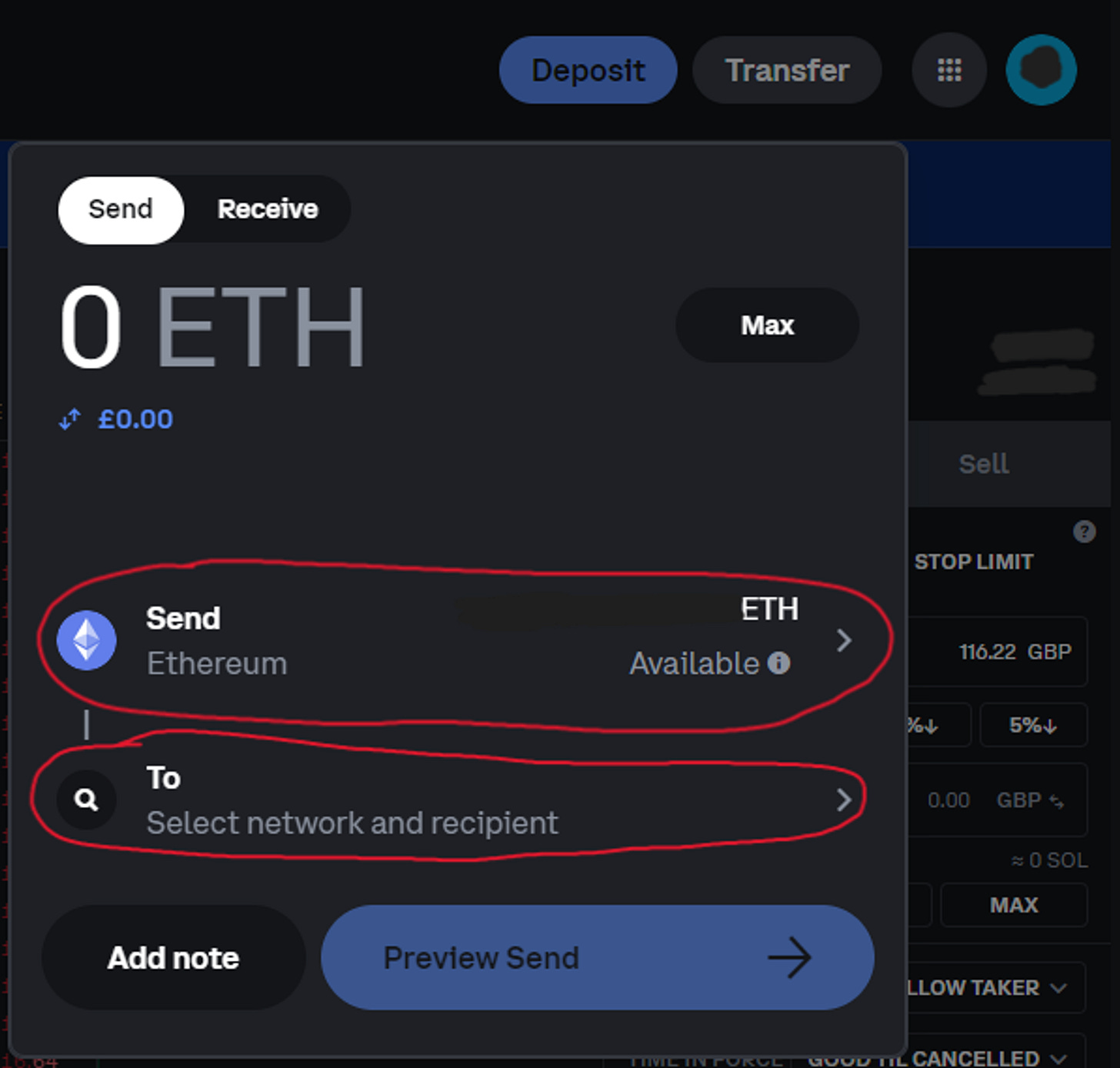

Pick the right crypto to send to the correct network (i.e. Send Solana to the Solana network, or ETH to the Base network):

Select the Base network if you are sending ETH to an ETH address:

Similarly, select the Solana network if you are transferring to a Solana wallet address:

Then finally paste the wallet address you copied earlier as the recipient address. You can add this address to your Coinbase contacts list to save it for frequent transfers:

After a minute or two you should see your cryptos show up in your wallet (Example with Coinbase wallet):

If you are playing on Solana, you’re ready to go on DEXes to get rekt, if you have chosen to play on Base, there’s one more step to go through.

Note that ETH transfers tend to be much more expensive than Solana transfers. If you are playing with only a tiny amount of capital, the network fee for the transfer to your wallet will eat into that. If you plan on topping up your wallet with ETH in the near future, it might make sense to aggregate the transfer to save on network fees.

To get crypto from your wallet to Coinbase and cash out with fiat simply follow the reverse process.

Bridging ETH to the Base network

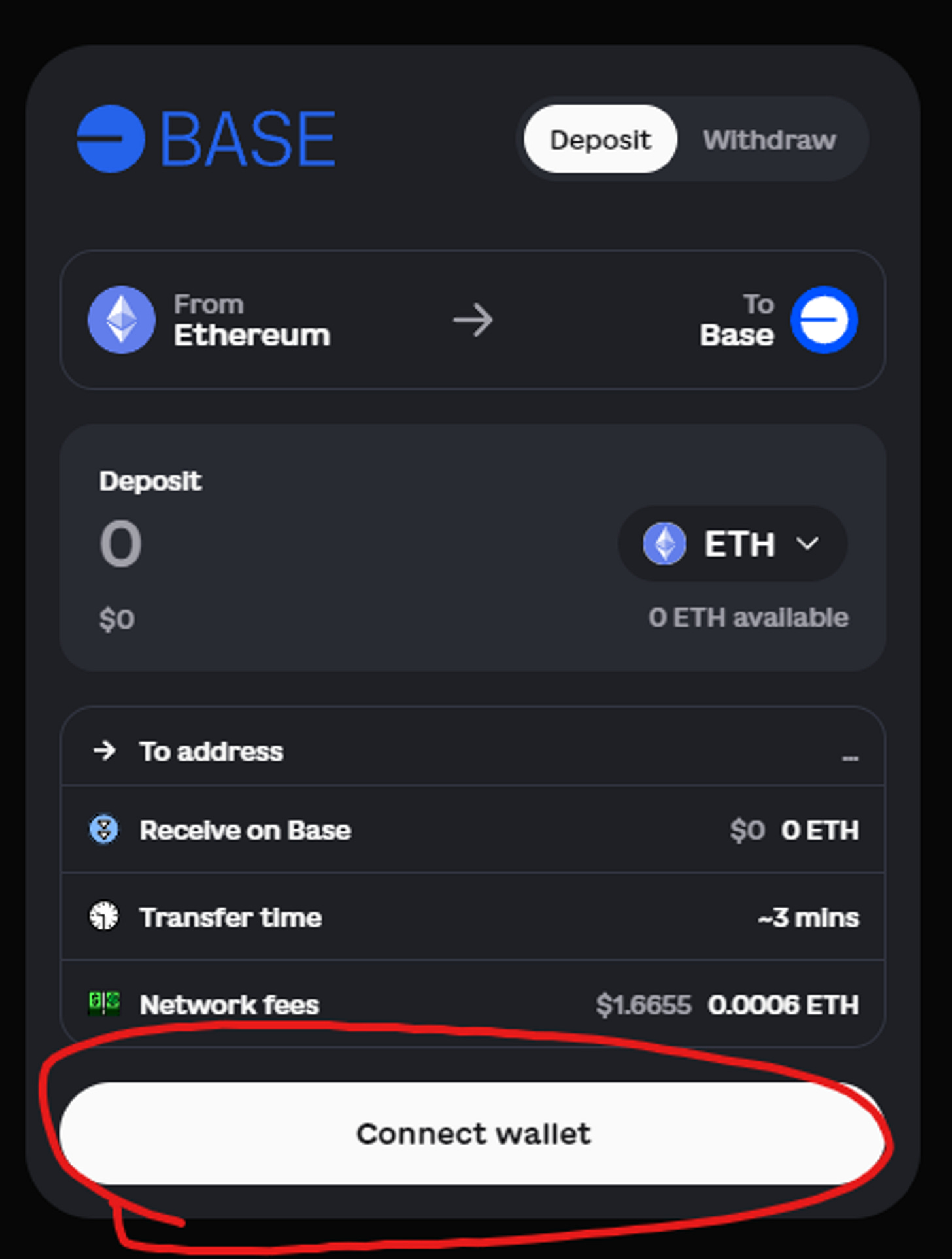

Base is a Layer 2 (L2) network built on top of the main ETH net by Coinbase. To use the ETH token on Base, you first need to bridge the token over to the Base network and wrap it so it conforms to the ERC-20 standard before it can be used to swap for tokens that reside on Base. To do this, go to either https://bridge.base.org/deposit or https://superbridge.app/base and connect your wallet to the exchange:

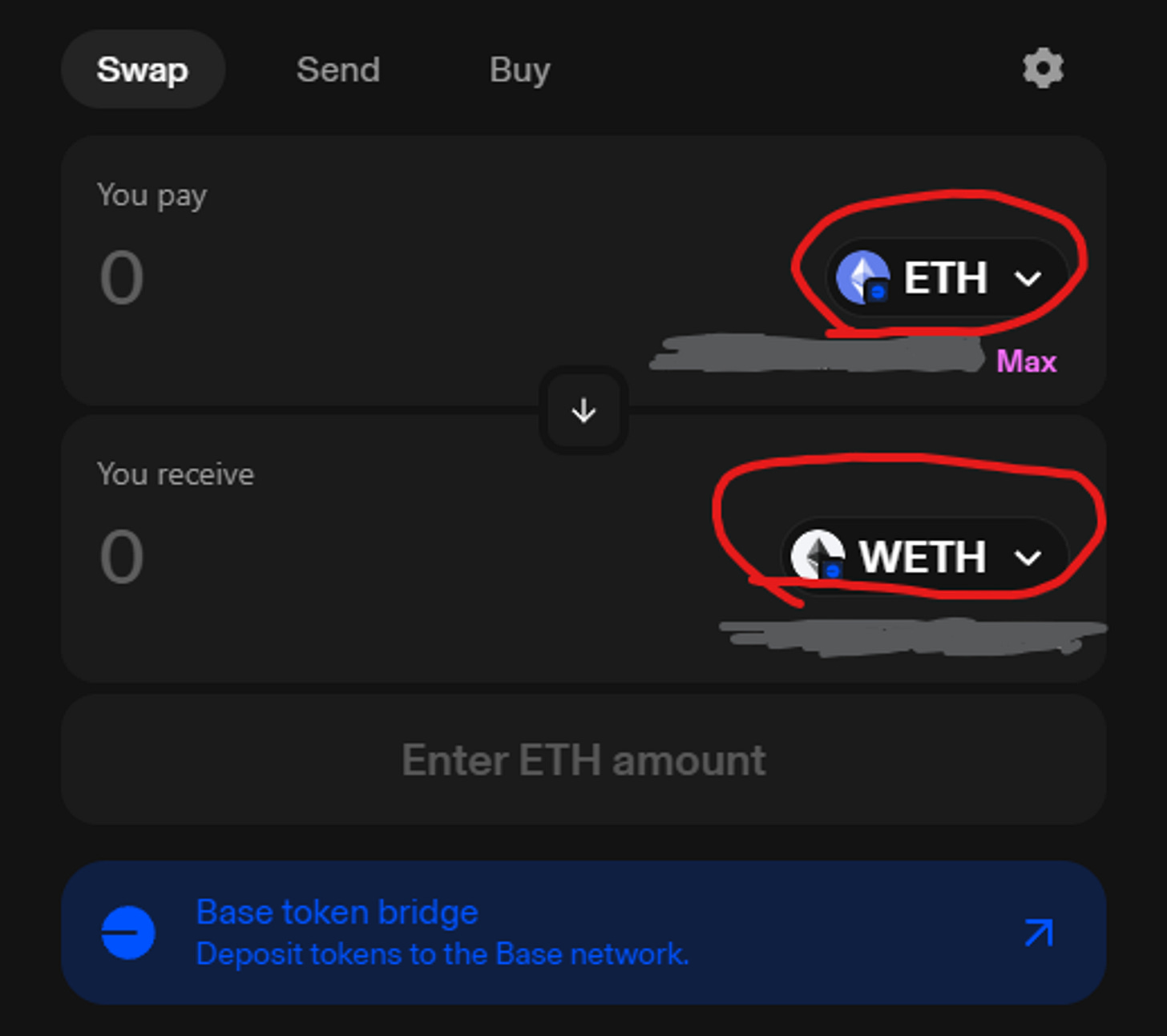

Once you have bridged your ETH to Base, it will show up in your wallet as ETH that resides on Base rather than the main Ethereum network. You will then have to proceed to Uniswap, a decentralized exchange, to wrap your ETH into WETH:

With this done, you are finally at the starting line for the ape race.

Swapping tokens on DEX

A good starting point to explore meme coins is cryptocurrency price tracking websites. The two most used are Coin Market Cap and Coin Gecko. These can help you explore some of the more mainstream tokens, what token pairs they are usually traded in, and which DEXes to trade them on.

Cryptocurrency price tracking sites are usually not completely up to date with DEXes. Your best resource for new tokens would be a DEX-monitoring platform or a sniper bot, both of which are less user-friendly but the most up to date with DEX token listings. Sniper bots will be covered in part 2. I have listed the major DEX-monitoring platforms below; they are mostly equivalent:

The main DEX-monitoring tools are integrated with DEXes and will allow you to trade tokens you find on them without needing to navigate to a DEX separately. There are different DEXes depending on what chain you are playing on. Should you wish to visit them directly, I’ve listed them below:

Solana:

Base:

To start buying meme coins, simply head to one of the DEXes listed above and you can search for meme coins to swap.

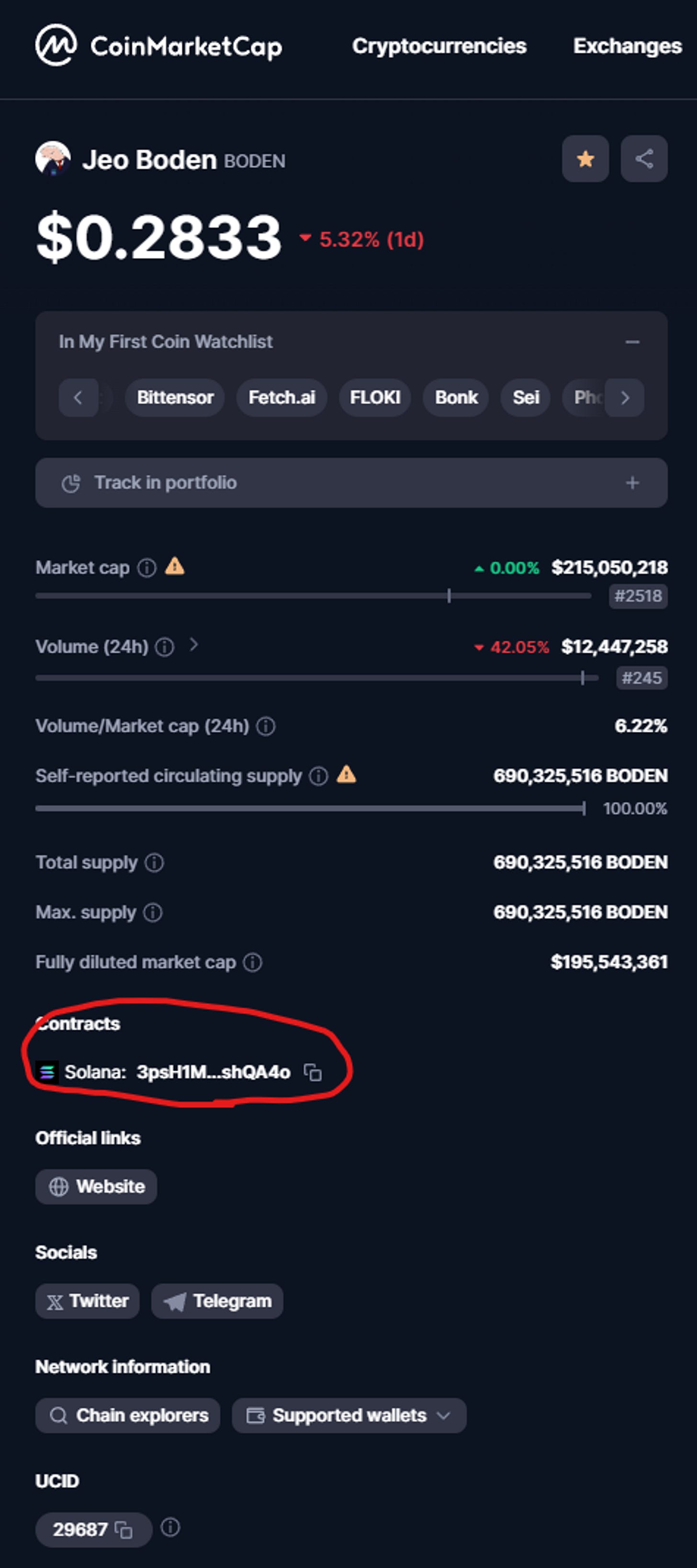

ALWAYS USE THE COIN ADDRESS

On DEXes, you can trade your Solana or WETH for any coin that exists on the network and has been listed on the DEX. The coins available here will be much more comprehensive than any you would find on CEX. However, when searching and swapping for a token on DEXes, ALWAYS USE THE COIN ADDRESS rather than the token name or ticker. Many tokens—including scam ones—use the same token names and tickers. There are now even tokens that have mutable names and tickers. Only coin addresses are immutable and truly identify a coin you are swapping for.

Here’s an example of where you can find the coin address of a token on Coin Market Cap:

Here’s where you can find the coin address on Dexscreener:

Once you have the address of the coin you want to swap for, head over to a DEX (e.g. Raydium in screenshot below) and connect your wallet. Ensure you are heading over to the correct official DEX URL. After connecting your wallet, click the token name in the “To” field of the swap:

A popup will appear and you can now search for tokens you want to swap. Copy and paste the coin address you found from earlier into the search field, and select the corresponding token to swap:

It can be quite normal for transactions to fail, the two most common reasons are due to slippage and network congestion. A slippage setting of 5%+ might be warranted for new tokens which tend to be quite volatile. You can set your slippage setting as below (Raydium example):

High slippage settings run the risks of getting front-run, but for very volatile meme coins, you may have to eat that risk as the time it takes to retry a transaction could result in massive swings in token prices.

Starting The Ape Race

Generated with Shadow AI

You’re now at the starting line for the ape race. In the next and last article of this series, I will cover additional tools (sniper bots, blockchain scanners, etc.), the actual tactics and strategies for sniping meme coins, and the due diligence that should be performed to maximize your chances. We will also explore other similarities (and also differences) to VC pre-seed investing, such as the number of shots on goal and holding back reserves for follow-on investments. To get notified about the next part, please subscribe to my Substack and follow me on Twitter.

Thank you to my wife Yijin, Kevin Zhang, Sheng Ho, and Andrew Li for helping review!

Glossary of Terms

Token: Interchangeable term with coin, cryptocurrency, cryptoasset, etc.

Blockchain network: A distributed ledger network. Different networks have different ecosystems and utilities. Some of the biggest ones right now are the BTC, ETH, and Solana networks. I won’t be going into the differences between L1s vs L2s, or EVMs, SVMs, etc.

CA: Coin address, an immutable string that represents the actual token itself on the blockchain network. The true representation of a coin’s identity.

Web3: Web 3.0, a catch-all term for a vision of the next iteration of the internet that can be trustless, permissionless, and decentralized.

Ecosystem: The platforms, exchanges, decentralized apps, systems, tokens, and community around a given blockchain network.

DeFi: Decentralized finance, financial systems and technologies built on top of blockchains. Often, any vaguely finance-related activity in the world of web3 falls under this umbrella.

CEX: Centralized exchange, businesses that help people trade cryptoassets, such as Coinbase, Binance, and FTX. All traditional finance businesses are “centralized”.

DEX: Decentralized exchange, a platform that facilitates peer-to-peer (P2P) transactions of crypto assets on a blockchain.

Swap: Used interchangeably with the verb “exchange”. Swapping or exchanging one token for another.

Pair: Refers to a trading pair listing of two tokens, typically the newly listed token and the native token of the blockchain. Basically, a “listing” on an exchange.

Custodial: Someone else manages your actual cryptocurrencies for you. If you don’t know anything about having a private key for your cryptoassets, then you’ve likely been using custodial crypto accounts.

Wallet: A non-custodial cryptocurrency wallet where you can manage and use your cryptocurrencies directly.

Dev: Short for developer, the person or team that actually created a cryptoasset.

ICO: Initial coin offering, the first time the cryptocurrency is offered for sale to someone besides the developer. The cryptocurrency may or may not be freely available to trade.

IDO: Initial DEX offering, the first time a cryptocurrency gets listed on a DEX and is freely available to trade by holders and anyone who wishes to swap it.

Gas fee/network fee: The cost to perform a cryptocurrency transaction as dictated by the blockchain network that the transaction happens on.

PnL: Profit and loss.

Rug: Short for rug pull, a generic term for an exit scam where the developer for a coin or web3 project disappears and cashes out through several different methods like liquidity pulls, fake projects, pump and dump, or simply disappearing with investor money.

Jeet: Someone who sells no matter what, sells for barely any profit, or panic sells.

Whales: Individuals or entities that hold a lot of cryptocurrency.

Makers: People who buy or sell a token, not to be confused with market makers in a traditional finance sense. DEXes use automated market making algorithms rather than order books.

Apes: Degenerates who trade memes, have high risk tolerance, and usually negative PnL.

Blue chip coins: The largest and most established cryptocurrencies that have large market caps, volume, and often history.

Stablecoins: Cryptocurrencies that are pegged to fiat currencies either by collateral, algorithms, or both. Theoretically the most stable and least volatile cryptocurrencies available. Most of the time, they are pegged to the USD (e.g., USDT, USDC, DAI).

Altcoins: Any cryptocurrency that is not BTC. There is overlap with blue chips and meme coins, and sometimes it simply refers to any coin that is not a blue chip token.

Meme coins/Shitcoins: Tokens that have inherently zero utility, the most volatile of any cryptocurrency asset class.

Liquidity pool (LP): On the most basic level, community/dev-funded blue chip tokens or stablecoins that actually back an asset and give it tradable value. In actuality, much more nuanced.

Burned: When certain tokens are permanently deleted and irretrievable.

Burned LP: Tokens that are permanently locked into the liquidity pool and not retrievable by whoever supplied that liquidity in the first place.